- A

- A

- A

- ABC

- ABC

- ABC

- А

- А

- А

- А

- А

- HSE University

- Faculties

- Faculty of Economic Sciences

- School of Finance

- News

- Efficient, but Not without Help

-

The School

- ABOUT

- Staff Members

- Doctoral Students

- Joint Departments with Partner Companies

-

RESEARCH ACTIVITIES

- Laboratories

- Series “Advanced Studies in Emerging Market’s Finance” at Springer Nature o Networking with International Academic Associations

- Networking with International Academic Associations

- Journal of Corporate Finance Research

- Research Seminars

- International PhD Workshop

- International Seminar “Systemic Risks in the Financial Sector”

- International Conference «ESG Corporate Dynamics: the Challenges for Emerging Capital Markets»

- Yasin (April) International Academic Conference

-

RESEARCH WORKING GROUPS

- Research Working Group "Innovations in the Banking Sector, its Financial Stability and Prudential Regulation"

- BUSINESS EDUCATION

- Networking with Business Associations

- Networking with Professional Associations

-

DATABASES

-

119049 Moscow, Russia

11 Pokrovskiy boulevard, room S629

Phone:

+7 (495) 772-95-90*27447, *27947, *27190

+7 (495) 916-88-08 (Master’s Programme Corporate Finance)

- Email: df@hse.ru

Head of Corporate Finance Research Center, Dr., tenured professor

The HSE School of Finance is the leading Russian competence center in the field of corporate finance, business valuation, banking, stock market, risk management and insurance, accounting and audit.

HSE is the first Russian university in the global ranking "QS - World University Rankings by subject", 2022 in the subject area of Accounting and Finance. Moreover, the university is the 1-st in the rating "THE World University Rankings by subject" in the subject area of Business & Management Studies, 2022

Edited by: A. M. Karminsky, Mikhail Stolbov.

Palgrave Macmillan, 2024.

Ivashkovskaya I., Ivaninskiy I.

Journal of Corporate Finance Research. 2025. Vol. 19. No. 3. P. 55-67.

Badr I., Rawnaa Ibrahim, Hussainey K.

In bk.: Opportunities and Risks in AI for Business Development. Vol. 2: 546. Bk. Opportunities and Risks in AI for Business Development. Prt. 636. Springer, 2025. P. 385-399.

SERIES: FINANCIAL ECONOMICS. WP BRP 60/FE/2017. НИУ ВШЭ, 2025

Efficient, but Not without Help

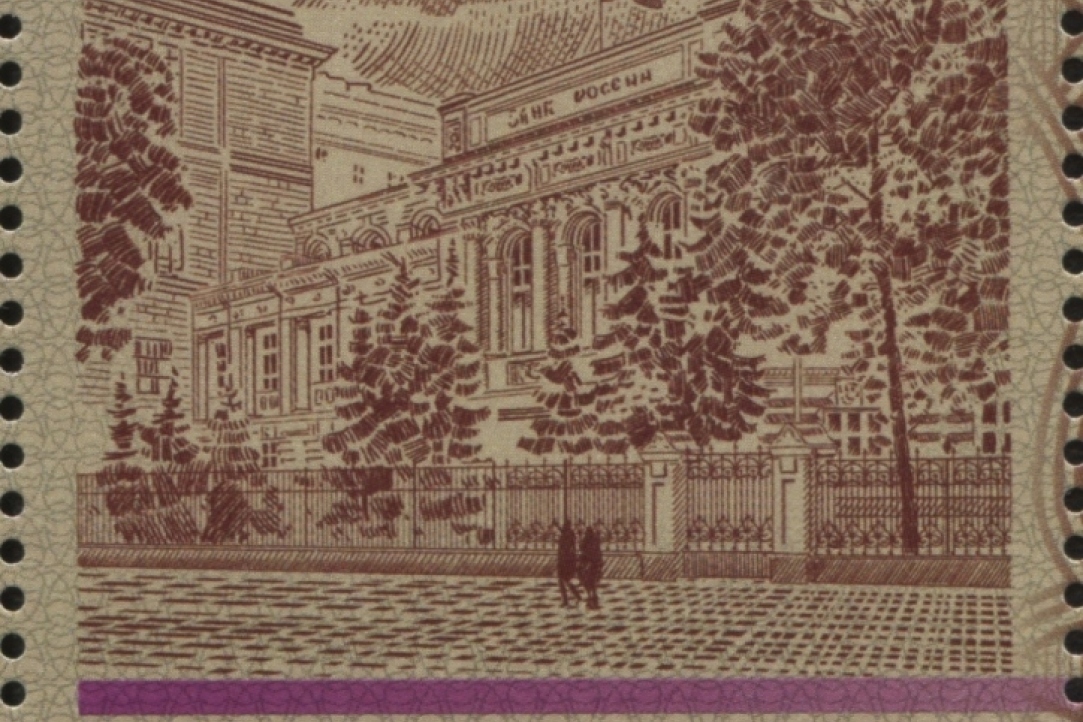

HSE University economists analyzed what banks performed best on the Russian market from 2004 to 2015 - state, private, or foreign-owned ones. They found out that during stable economic and political periods, foreign-owned banks tend to take the lead, while during a crisis period, such as from 2008 to 2013, state-owned banks outperformed them. The article was published in the Emerging Markets Finance and Trade journal.

Empirical studies have shown that efficiency in the banking sector generally correlates with a country’s economic growth. A bank’s efficiency is impacted by many factors, including its assets and liability structure, as well as its specialization (household deposit, securities, or investment banking). The type of ownership — public or private — also plays a role. Furthermore, depending on the overall macroeconomic environment, private or state-owned banks may perform better. This is the first time such an analysis has been carried out in Russia.

The focus of leading banks is profit efficiency. State-owned banks, in addition to operational goals, carry out social objectives as well, such as offering reduced mortgages to military personnel or other eligible beneficiaries.

In regards to foreign private-owned banks, they generally enter new markets with only one goal - profit generation. Russia used to be quite attractive in this regard, at least from 2004 to 2009, when the interest margin was almost four times higher than in Europe (8.02% vs. 2.24%).

The proportion of state-owned and foreign-owned banks in terms of total assets in the banking sector changed over 11 years, from 2004 to 2015. According to the Bank of Russia’s data, this share increased rapidly from 40% in 2004, to 52% in 2008, and 61.5% in 2015, respectively. In addition, the share of foreign-owned banks started out at 7.3% in 2004 and climbed to 18.7% in 2008. However, the global financial meltdown impacted them more harshly than others, and by 2015, their share of assets fell to 13%. At the same time, the share of privately-owned Russian banks also decreased significantly. Standing above 50% in 2004, their share fell below 30% by 2015

Research Methods

Economists at HSE University analyzed reported data from 240 banks, which, in aggregate, represent 91% of total banking assets in Russia. They aimed at identifying the factors as to why the return on assets (ROA) for certain banks fell behind the optimal level.

The ‘suspects’ included the banks’ ownership, as well as those indicators characterizing assets and liability structures and the risk profiles of loan portfolios. The researchers analyzed the share of household deposits in total deposits, the share of household loans in banks’ loan portfolios, and the share of loan loss provisions to total loans. These particular indicators can characterize a bank’s focus and credit risk level.

A bank’s profit efficiency demonstrates how it manages its profits. As such, a lack of efficiency may show up in banking services, which might be too expensive or not popular among the bank’s clients.

‘To model profit function, we relied on three factors: labour, capital, and deposits. We believed that for banks, deposits are the main resource,’ explained Veronika Belousova, one of the study’s authors, adding: ‘The profit function included the cost of these resources (cost of labour = personel expenses/total bank assets; cost of capital = operational costs/fixed assets; cost of deposits = interest paid on deposits/volume of deposits). Also, loans and securities were investigated as banking products. ROA was a dependent variable in regards to this function’.

In addition to these indicators, the researchers considered several additional factors, such as currency exchange rates, banks’ capital adequacy (as risk buffer), their location and specialization, and the size of their branch networks.

The profit function was modeled for different time periods, taking into account crises experienced by the Russian economy: i.e., the 2004 liquidity crisis, the 2008-2010 economic meltdown, and the geopolitical crisis that started in spring 2014.

Outcomes

This empirical study indicates that the profit efficiency of state-owned banks during crisis periods was better than that of private-owned banks. The researchers note that this phenomenon, in conjunction with the fact that state-owned banks have more resources, help them outperform competitors in terms of volume of household loans, attracting payroll projects (e.g., state-owned firms), and offering payments services to their corporate clients. In addition, state-owned banks are able to reduce the share of less profitable interbank loans.

The introduction of Russia’s deposit insurance system and the 2004 crisis forced many firms to transfer their accounts from private to state-owned banks. As a result, the former was unable to compete with the latter in pricing their services, resulting in a decline of long-term and stable funding sources and, consequently, higher liquidity risks.

Today, state-owned banks lead in household (68.4%) and corporate (72.8%) loans, respectively. Furthermore, interbank loans have started taking a larger share in the loan portfolios of privately owned banks.

During the more ‘peaceful’ years (from January 2004 to June 2008, and January 2014 to October 2015) foreign-owned banks turned out to be more profit-efficient (i.e., their ROAs were closer to optimal) on the Russian market. The researchers believe that one of their key advantages is better management practices, as instructed by their mother institutions. This largely concerned all areas of activity, from routine standardization of business processes and faster decision-making, to introducing new technologies and unifying risk assessment instruments.

However, during the crisis, from July 2008 to December 2013, state-owned banks performed better in terms of profit efficiency. According to the researchers, this happened due to their larger capital stocks and ability to replenish them. ‘This situation is characteristic of countries where there are more monopolies and state banks in the economy,’ the authors concluded.

IQ

- About

- About

- Key Figures & Facts

- Sustainability at HSE University

- Faculties & Departments

- International Partnerships

- Faculty & Staff

- HSE Buildings

- HSE University for Persons with Disabilities

- Public Enquiries

- Studies

- Admissions

- Programme Catalogue

- Undergraduate

- Graduate

- Exchange Programmes

- Summer Schools

- Semester in Moscow

- Business Internship

- © HSE University 1993–2025 Contacts Copyright Privacy Policy Site Map

- Edit